All Categories

Featured

State Farm representatives offer everything from house owners to car, life, and other prominent insurance coverage items. So it's simple for agents to pack services for price cuts and easy plan administration. Lots of consumers enjoy having actually one trusted agent take care of all their insurance needs. State Farm uses global, survivorship, and joint universal life insurance policy policies.

State Farm life insurance coverage is generally conventional, providing steady alternatives for the typical American family members. If you're looking for the wealth-building opportunities of universal life, State Farm does not have affordable choices.

Yet it doesn't have a solid visibility in other financial products (like global plans that unlock for wealth-building). Still, Nationwide life insurance policy plans are very available to American families. The application procedure can likewise be more convenient. It aids interested parties get their foot in the door with a reliable life insurance coverage strategy without the much more complex discussions concerning investments, financial indices, and so on.

:max_bytes(150000):strip_icc()/Pros-and-cons-indexed-universal-life-insurance_final-1b83c0fd52154eb69edd47f99ab8927a.png)

Nationwide fills up the vital function of obtaining reluctant buyers in the door. Also if the worst happens and you can't obtain a larger strategy, having the security of a Nationwide life insurance policy policy could change a purchaser's end-of-life experience. Review our Nationwide Life insurance policy evaluation. Insurer make use of medical examinations to assess your risk class when making an application for life insurance.

Purchasers have the alternative to change prices monthly based on life circumstances. Certainly, MassMutual supplies interesting and potentially fast-growing chances. However, these plans often tend to execute ideal in the future when early deposits are higher. A MassMutual life insurance policy representative or monetary consultant can aid purchasers make plans with area for modifications to meet temporary and long-lasting economic objectives.

Whole Life Versus Universal Life

Read our MassMutual life insurance policy testimonial. USAA Life Insurance Policy is understood for offering budget-friendly and comprehensive economic items to armed forces members. Some purchasers might be surprised that it provides its life insurance policies to the general public. Still, armed forces members delight in unique advantages. As an example, your USAA policy features a Life Event Choice biker.

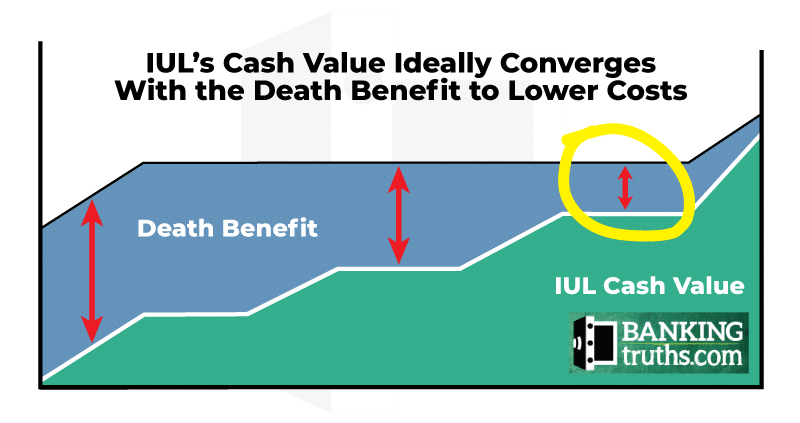

If your policy doesn't have a no-lapse warranty, you might also shed coverage if your cash money worth dips listed below a particular limit. It may not be a wonderful choice for individuals who merely desire a fatality advantage.

There's a handful of metrics through which you can evaluate an insurance provider. The J.D. Power consumer complete satisfaction rating is a good choice if you desire a concept of exactly how customers like their insurance coverage. AM Finest's economic strength ranking is one more important metric to take into consideration when picking an universal life insurance policy business.

This is especially important, as your money value expands based on the financial investment choices that an insurance coverage business provides. You need to see what investment options your insurance company offers and compare it versus the goals you have for your policy. The ideal method to locate life insurance policy is to collect quotes from as several life insurance policy business as you can to understand what you'll pay with each plan.

Latest Posts

Death Benefit Option 1

Index Insurance Company

Index Life Insurance Pros And Cons